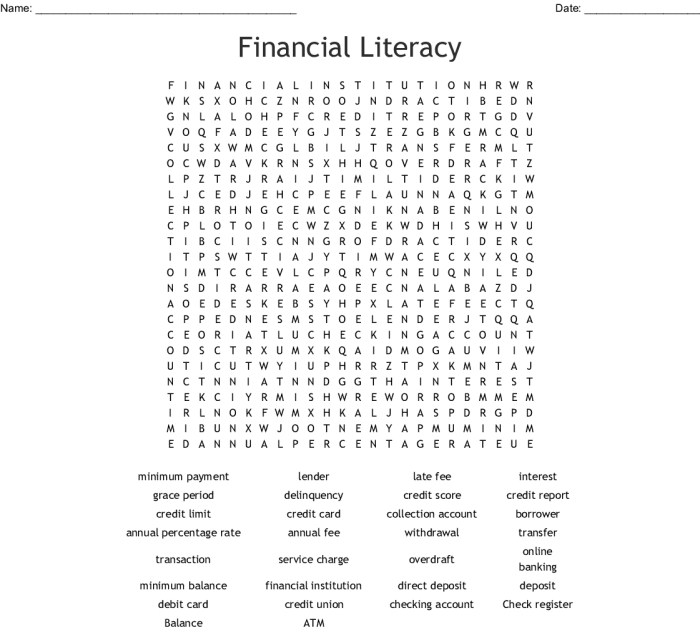

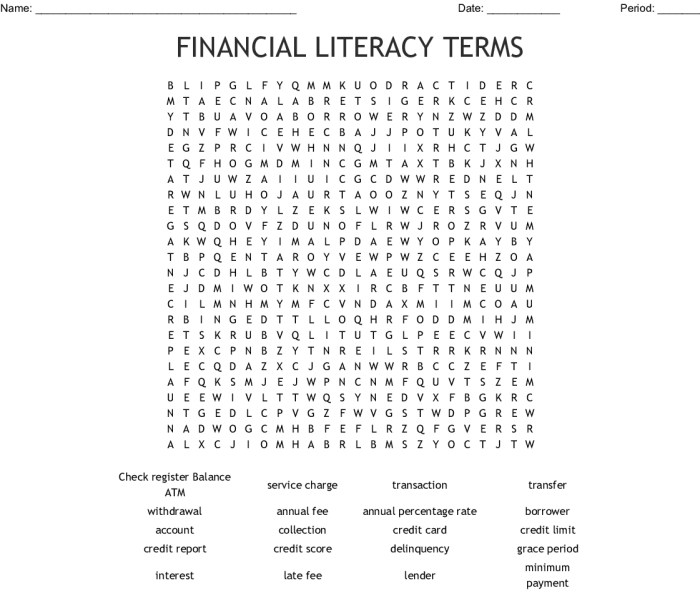

Financial literacy word search answers offer a unique and engaging way to delve into the realm of personal finance, empowering individuals to make informed financial decisions and achieve financial well-being.

Understanding financial concepts, managing debt, and planning for the future are crucial aspects of financial literacy. By engaging in word search puzzles tailored to this subject, individuals can not only test their knowledge but also reinforce key principles and enhance their financial literacy.

Understanding Financial Literacy

Financial literacy is the ability to understand and manage personal finances effectively. It encompasses knowledge of financial concepts, skills in managing money, and the ability to make informed financial decisions. Financial literacy is crucial for individuals to achieve financial well-being and secure their financial future.

Key components of financial literacy include:

- Understanding income and expenses

- Budgeting and managing debt

- Investing and saving

- Insurance and risk management

- Retirement planning

Financially literate individuals are able to track their spending, create and adhere to budgets, plan for retirement, and make informed investment decisions. They understand the risks and rewards associated with different financial products and services, and they are able to manage their finances in a way that meets their short-term and long-term financial goals.

Benefits of Financial Literacy

Financial literacy offers numerous personal benefits, including:

- Reduced financial stress and anxiety

- Improved financial decision-making

- Increased financial security

- Higher earning potential

- Greater control over personal finances

Individuals with financial literacy are more likely to make informed decisions about their finances, avoid unnecessary debt, and build wealth over time. They are also more likely to be prepared for financial emergencies and to achieve their financial goals.

For example, a financially literate individual may be able to negotiate a lower interest rate on a loan, choose a suitable investment strategy, or save for a down payment on a home.

Improving Financial Literacy

Improving financial literacy requires a commitment to learning and taking action. Individuals can access financial literacy resources through:

- Online courses and workshops

- Books and articles

- Financial counseling services

- Non-profit organizations

- Schools and universities

Effective methods for increasing financial knowledge include:

- Reading financial publications

- Attending financial literacy workshops

- Seeking advice from financial professionals

- Creating a budget and tracking expenses

- Exploring different investment options

Developing good financial habits is essential for long-term financial success. These habits include:

- Saving regularly

- Investing wisely

- Avoiding unnecessary debt

- Living within your means

- Planning for the future

Impact on Financial Well-being: Financial Literacy Word Search Answers

Financial literacy has a profound impact on financial well-being. Individuals with higher financial literacy are more likely to:

- Have higher credit scores

- Own homes

- Save for retirement

- Experience less financial stress

- Achieve their financial goals

Financial literacy empowers individuals to make informed decisions about their finances, which can lead to greater financial stability and well-being. By understanding financial concepts and managing their money effectively, individuals can reduce financial risks, build wealth, and secure their financial future.

Challenges in Achieving Financial Literacy

Despite its importance, achieving financial literacy can be challenging for several reasons:

- Lack of financial education

- Cultural and social factors

- Limited access to financial resources

- Cognitive biases and behavioral traps

- Predatory financial practices

Improving financial literacy requires addressing these challenges through:

- Improving financial education in schools and universities

- Providing financial counseling services to underserved communities

- Regulating predatory financial practices

- Promoting financial literacy campaigns and initiatives

- Encouraging individuals to take responsibility for their financial well-being

General Inquiries

What is the importance of financial literacy?

Financial literacy empowers individuals to make informed financial decisions, manage their finances effectively, and achieve their financial goals.

How can financial literacy improve financial decision-making?

Financial literacy provides individuals with the knowledge and skills to assess financial information, evaluate risks and returns, and make sound financial choices.

What are some examples of financially literate individuals?

Financially literate individuals are those who possess a comprehensive understanding of financial concepts, can manage their finances responsibly, and make informed financial decisions.